Credit Risk Prediction

Project Description

Developed a regression model in Python, to predict credit risk and loan repayment outcomes using customer employment and financial behavior, optimizing feature engineering and trade-offs between precision and recall.

Screenshots

Detailed Tasks

- Data collection and integration from multiple sources

- Data cleaning and preprocessing for analysis

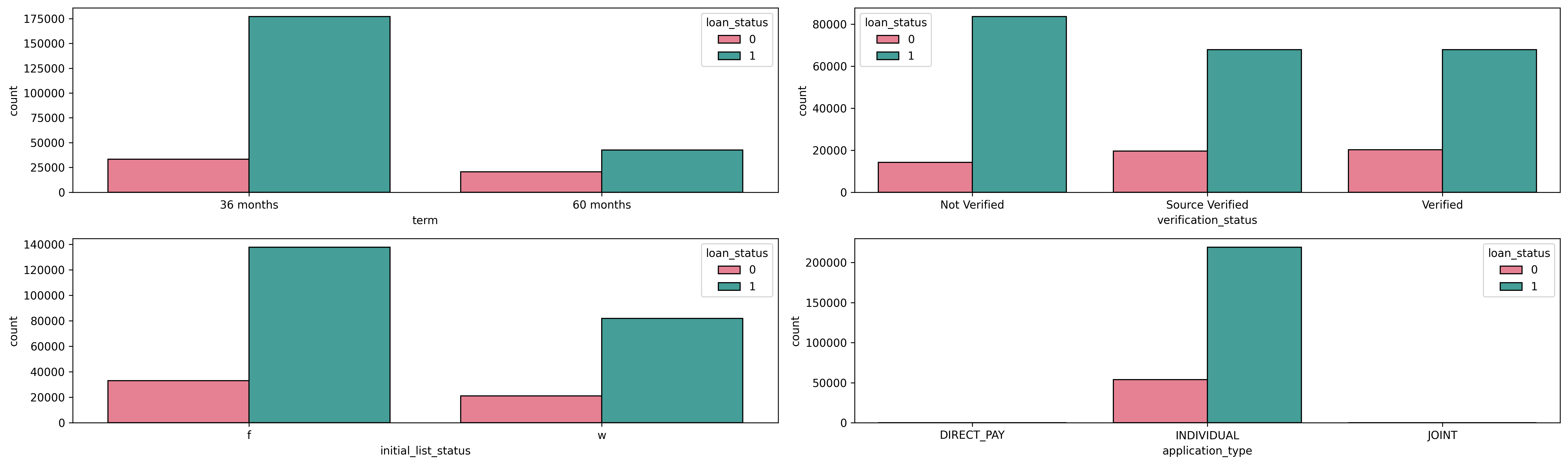

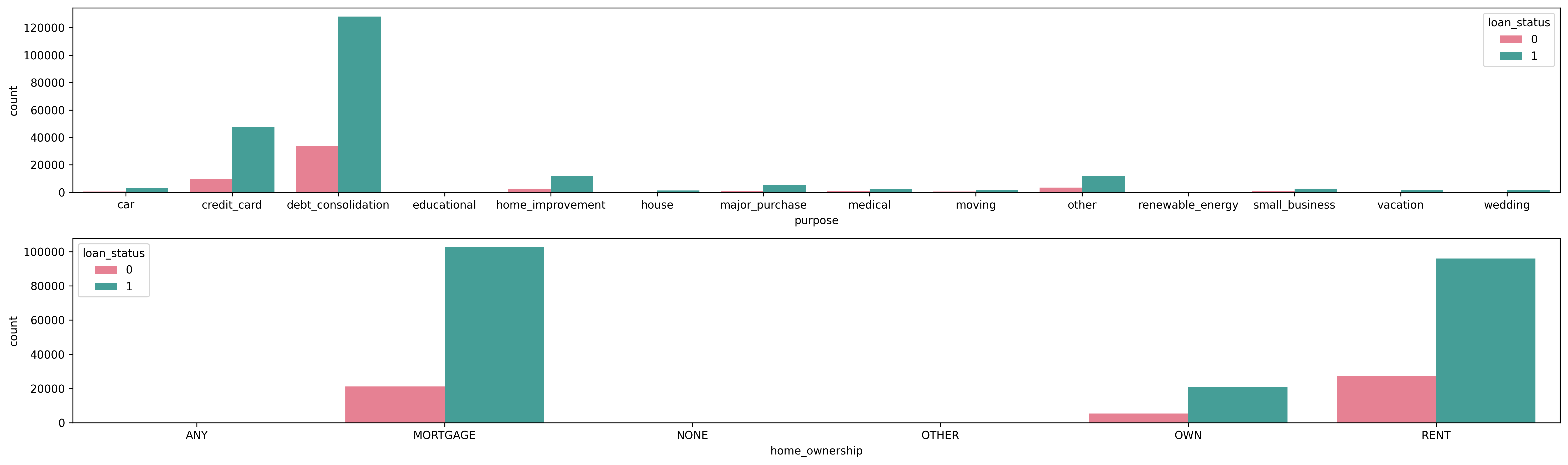

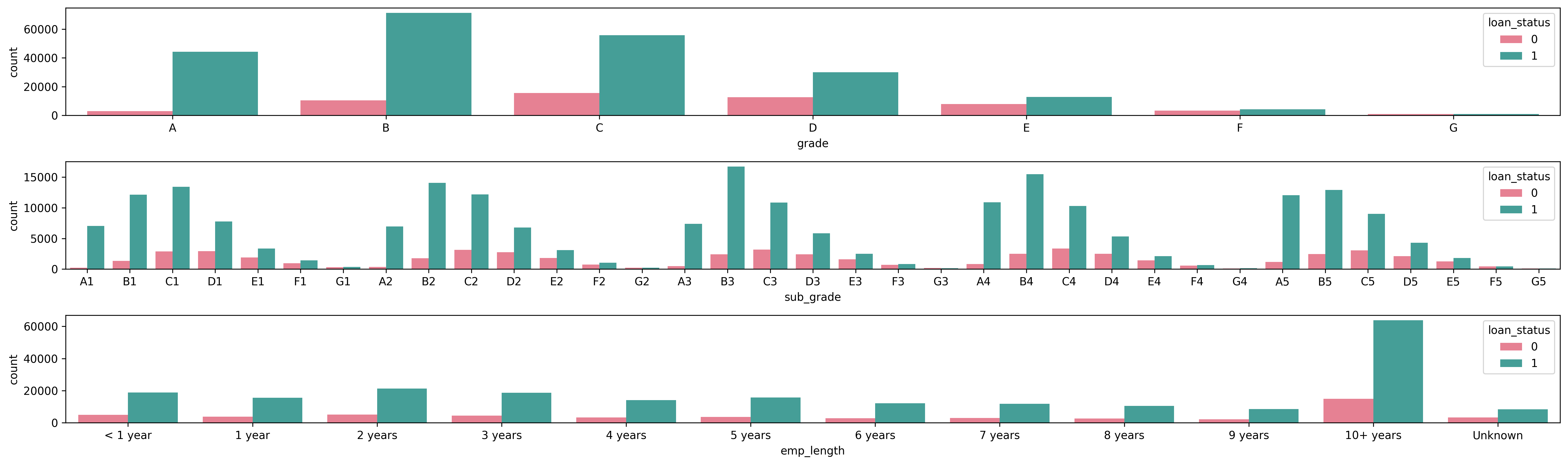

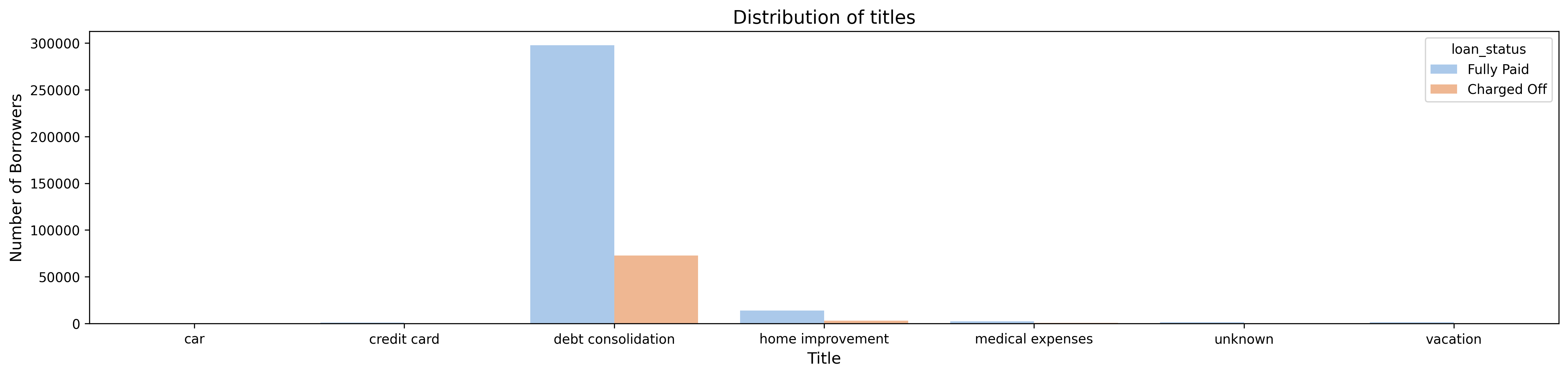

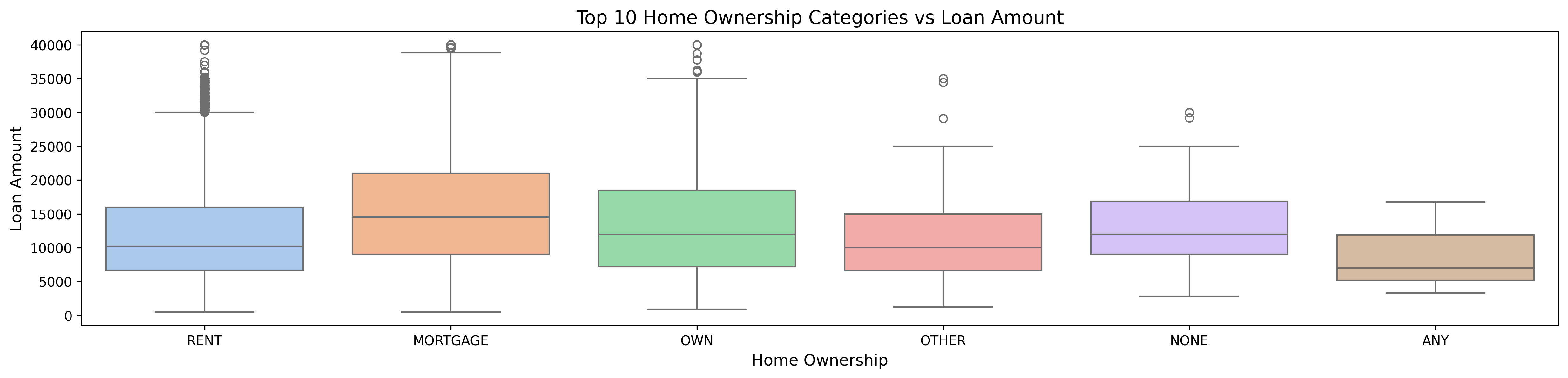

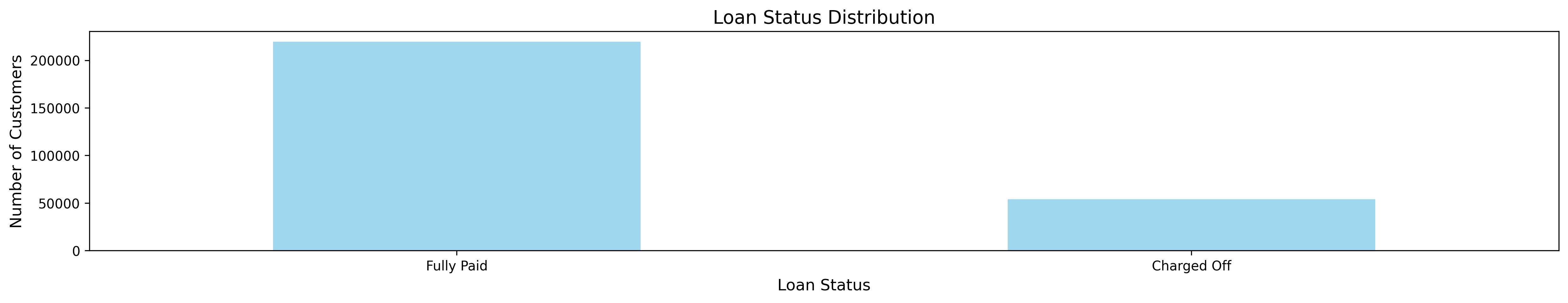

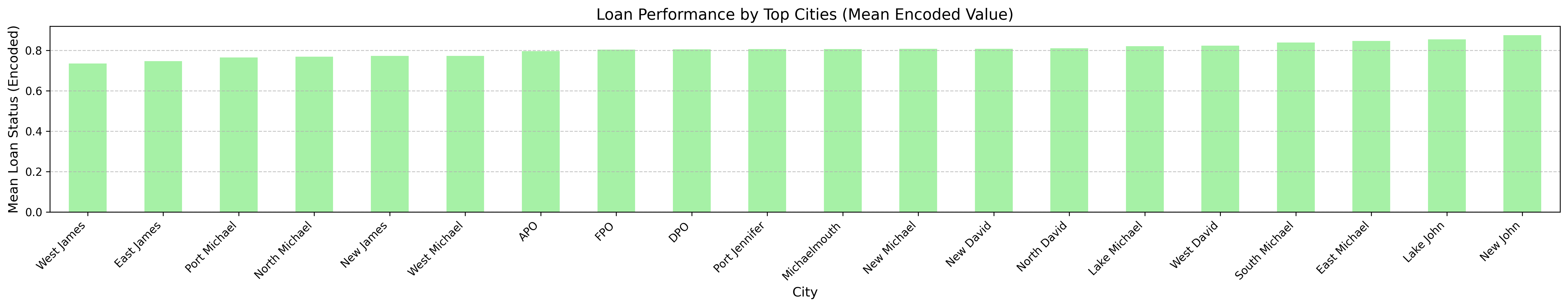

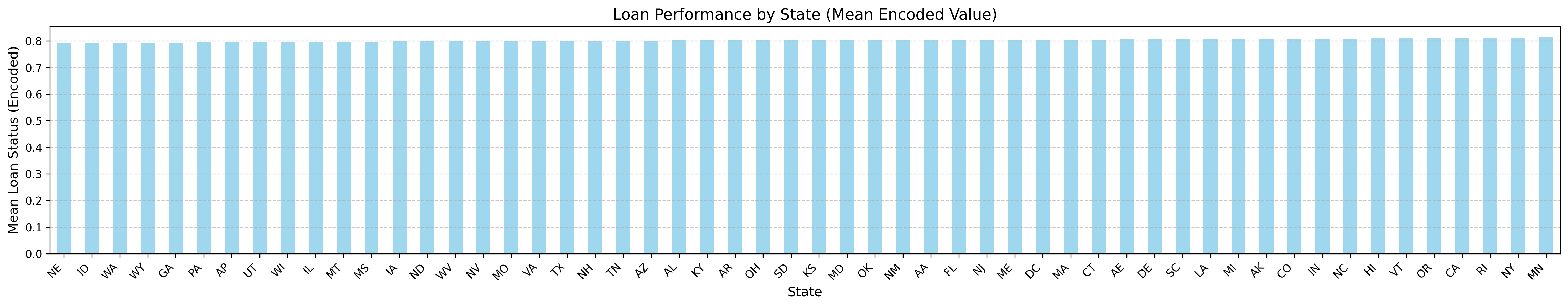

- Exploratory data analysis to identify trends and patterns

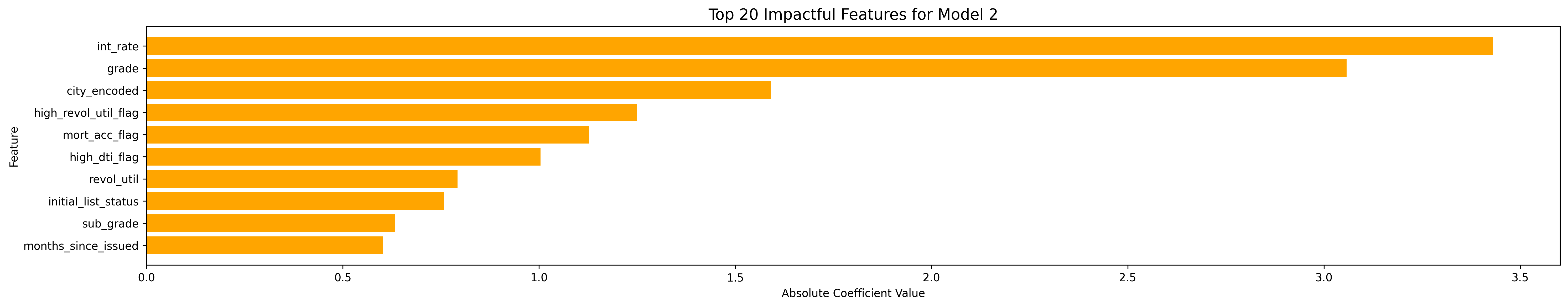

- Feature engineering for model improvement

- Development of classification models for risk prediction

- Model evaluation and validation

- Visualization of key metrics for stakeholders

Core Skills

Machine Learning

Feature Engineering

Data Preprocessing

Risk Assessment

Logistic Regression

Model Evaluation

Data Analysis

Python

Statistical Analysis

Classification Models

Model Validation

Business Intelligence

Tech Stack

Programming & Tools

- Python

- SQL

- Excel

Data Analysis

- Exploratory Data Analysis

- Data Preprocessing

- Statistical Analysis

- Feature Engineering

Machine Learning

- Classification Models

Business Impact

- Achieved 92% accuracy in credit risk prediction